Top 10 CEOs Whose Crimes Sent Them to JAIL

Not all business people are honest, and there are some Wall Street executives in jail to prove that. Whether it's someone like Jeffrey Skilling and his shady bookkeeping for Enron, Tyco's Dennis Kozlowski and his $6,000 shower curtains, Rite Aid's Martin Grass or Cendant's Walter Forbes, there are many high-ranking executives that served jail time for their white-collar crimes. WatchMojo counts down ten high-level businesspeople who served hard time in prison.

Special thanks to our user MikeyP for suggesting this idea! Check out the voting page at http://www.WatchMojo.comsuggest/Top%2010%20Infamous%20CEOs%20Who%20Went%20To%20Jail

#10: Calisto Tanzi

In 2003, the Italian food and dairy corporation Parmalat filed for bankruptcy. With over 14 billion dollars in debt, this step only made sense, but it soon emerged that sinister activities were taking place beneath the surface. Mr. Tanzi was a trusted founder of Parmalat – so trusted that no one suspected he had embezzled over 800 million euros from the company. The businessman was sentenced to 10 years in prison in 2008. A series of appeals, and additional sentences followed which upped that time to about 17 years. To this day, The Parmalat scandal remains the largest bankruptcy in European history.

#9: Sanjay Kumar

Kumar worked his way up the corporate ladder at Computer Associates International and eventually became CEO in 2000. His term in this prestigious position was short-lived, however. He was investigated for fraud four years later, and it was revealed that Sanjay had been cooking the books, leading to billions of dollars of discrepancy. One method he used in his accounting gymnastics earned the nickname “the 35 day month.” In 2006, the former CEO was finally convicted of obstruction of justice and securities fraud. Calling his cover-up “the most brazen and comprehensive in the modern era of corporate crime,” the judge sentenced him to 12 years in prison. Oh, and he has to pay almost $800 million in restitution.

#8: Richard M. Scrushy

Accounting fraud is hardly a sexy crime, and perhaps this is one reason why so much of it goes unnoticed. Scrushy founded a healthcare company in Alabama called HealthSouth in 1984, and gained notoriety for illicit accounting practices in 2003. Scrushy’s first trial for fraud, money laundering and conspiracy ended in an acquittal in 2004. But a new federal trial in 2005 ended with convictions for bribery, fraud and conspiracy. Scrushy was sentenced to 7 years in prison. He was later found guilty in a civil trial and ordered to pay $2.87 billion in damages. He was released in 2012 from federal prison, and has actually been outspoken about the government’s lackadaisical approach to white collar crime nowadays.

#7: Martin Grass

When you think of Scranton, Pennsylvania, you may think of the cozy town with loveable working class employees as seen in “The Office,” but the story behind Scranton native drugstore chain Rite Aid paints a different picture. From its humble beginnings in the 1960s, the business grew significantly over the next three decades. But it took a turn for the worse when its founder’s son, Martin Grass, took over in 1995. Grass thought it would be wise to systematically overstate Rite Aid’s earnings in an effort to grow the company. This almost destroyed the drugstore chain; Grass was caught up in a $1.6 billion scandal and sentenced to 8 years in prison.

#6: Walter Forbes

Cendant Corporation was formed from a merger of Hospitality Franchise Systems and Comp-U-Card International, and might have gone on its merry way had they not allowed Walter Forbes to become CEO. Merging companies is a great way to create synergies that make a company altogether more efficient– in theory. Unfortunately, Cendant Corporation soon found that Comp-U-Card’s efficiencies had been, shall we say, overstated by its then-CEO, Forbes. He claimed to have unknowingly reported $500 million in imaginary earnings, but supposed ignorance is hardly bliss in this situation. Forbes was eventually sentenced to 12 years in prison and $3.28 billion in damages.

#5: Dennis Kozlowski

Tyco is an international business that focuses largely on security solutions and fire protection. Despite this, its internal security was clearly lacking in at least one instance. When images of the lavish Wall Street lifestyle of the 90s come to mind, know that Kozlowski was a poster boy for this image. Before indictment, he owned a $30 million NYC apartment complete with $6,000 shower curtains. It turns out that was in part thanks to a scheme that gave him over $80 million in unauthorized bonuses. Kozlowski was sentenced to a minimum of 8 years and 4 months in 2005.

#4: Jeffrey Skilling

When phrases like white-collar crime are brought up, Enron is typically one of the first associations to be made. Skilling was one of the main perpetrators behind this catastrophe, and it started with a book keeping technique known as mark-to-market accounting, a technique that records assets based on expected values as opposed to actual values. The next step was creating an Enron subsidiary to sweep all debt under the rug when this proved to be inadequate. Upon discovery, $405 million in losses were reflected overnight, and Skilling was slapped with 24 years in prison.

#3: Bernard Ebbers

Ebbers helped create Long Distance Discount Services, Inc., a telecommunications firm that eventually became WorldCom in the coming years. His Greek tragedy began to unfold as Icarus flew too close to the sun in 1999 with an announcement that WorldCom intended to purchase Sprint. Antitrust laws resulted in the deal not going through, and subsequently in a massive drop in WorldCom stock. Instead of downsizing or waiting it out, Ebbers worked with a team to employ elaborate accounting gymnastics, which resulted in $11 billion overstated on the books. This did not bode well for the company, nor the businessman himself who is working on a 25-year sentence in Louisiana.

#2: Allen Stanford

Stanford actually made his first attempt at professional success with a bodybuilding gym in Texas. This eventually failed, and he moved into finance soon after, ultimately becoming Chairman of the Stanford Financial Group. They began to catch the attention of the SEC and FBI due to consistently high returns compared to the market. When the Stanford Financial offices were raided in 2009, the cover was blown off of a massive Ponzi scheme. Stanford still publicly states that the company never swindled anyone, but his unwillingness to acknowledge clear facts didn’t stop him from receiving a 110-year sentence. At least he’ll have plenty of time to pursue his bodybuilding dream.

Before we unveil our number one pick, here are a few honorable, or in this case, dishonorable mentions:

- Martha Stewart

- Samuel D. Waksal

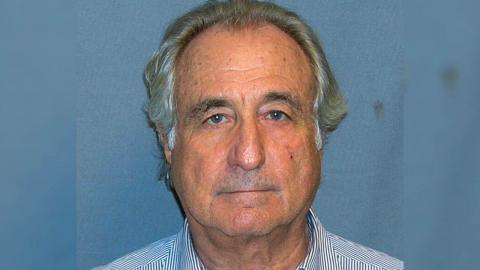

#1: Bernie Madoff

He’s behind the largest financial fraud in U.S. history. The Bernard L. Madoff Investment Securities LLC was highly respected on Wall Street, and everyone from individual investors to charities was more than happy to entrust him with their life savings. His returns were considerable, but every bit of this was fabricated and Madoff was effectively taking money from investor’s pockets. He was eventually sentenced to 150 years in federal prison, but irreparable damage had been done to countless victims in the process. Today, many think of him as an embodiment of corporate greed, Wall Street corruption, and capitalism run amuck.