Top 10 Scams

Beware the crooks, the cheats and the shysters. In this video, http://www.WatchMojo.com counts down our picks for the top 10 scams. While some of these rip-offs have been around for decades – even centuries – modern swindlers are utilizing innovations in digital communication to pick our pockets and hide their tracks. With this in mind, we looked at both common cash grabs and complex long cons that have defrauded millions of people out of their hard-earned money, in recent years.

Special thanks to our users jkellis, thomaszeblob, Thedarkfoxcannon, Opst3r, TheMikeDoesRandom and LoveMyTwinkie246810 for submitting the idea on our Suggestions Page at WatchMojo.comsuggest

#10: 900 Phone Number Scams

Call 1-900-it’s-a-scam. Simple versions of this scam are akin to the lottery con: Someone’s sent news that they’ve won a prize, but must call a premium-rate phone number (starting with 1-900) to claim it. In more sophisticated 900-scams, computer hackers secretly download dial-up services onto home computers, then make roll-calls to a 900-number. Victims of both scams only realize they’ve been duped once they receive an exorbitant phone bill. And while it’s possible that not all numbers that start with 1-900 are scams, most phone cons rely on 900-numbers.

#9: Work at Home Scam

Make cash from the comfort of your couch! These get-rich-quick schemes promise easy work-at-home opportunities. Many are veiled pyramid schemes, while others require the upfront purchase of expensive training kits, or involve jobs like forum spamming and data entry, which fail to pay participants when the work is done. Most legitimate home-based careers require higher education in a specialized field. So if a job seems too good to be true, it probably is.

#8: Weight Loss Scam

Need to drop a few pounds? Weight-loss scams promise quick and easy weight-loss solutions with little to no effort. But those creams, patches and shakes that claim to “melt-away the fat” are backed by very little scientific research. Though attractive models may tout the benefits of these products, proper diet and exercise is the only real way to get in shape. So, avoid the gimmicks, eat right and get active. Your body and your bank account will thank you.

#7: Romance Scam

Love is blind, but don’t get blind-sided. One of the oldest tricks in the book, the romance scam has taken on a new level of sophistication with the help of the internet. Contemporary con-artists create fake profiles on legitimate dating websites. They lure their victims by cultivating fake relationships in order to emotionally manipulate their targets, tugging at their heartstrings to defraud their so-called love out of money. Love hurts!

#6: Lottery Scam

Congratulations: you’ve won the lottery! Or have you? This advanced-fee con begins with a surprise phone call or email claiming that someone has won the lottery. In order to get the prize a supposed-winner must pay a fee to gain access to the jackpot. These cons claim never to have issued tickets for the contest, which is actually a telltale sign of fraud, since all legal lotteries or draws must always sell tickets first.

#5: Pyramid Scheme

Watch out! You’re selling a scam. Indicative of the name, this finance scheme creates a pyramid whereby initial promoters recruit investors who are then required to recruit more investors. This scam often requires participants to sell a product, in order to look legitimate, masking the priority to continually court new financiers. The fraud is complete when initial promoters make money, the pyramid collapses, and the rest of the investors are left in the lurch.

#4: Advanced Fee Loan

There’s no such thing as almost free money! Unlike legitimate pre-qualified loans, a pre-approved loan is an unsolicited guarantee of some kind of credit, which requires no vetting, but asks the recipient to pay processing fees. These pay-upfront credit scams come in the form of online ads, emails, or even household calls. So how do you spot this scam? Simple: a legitimate lender will NEVER ask for, or accept, any payment before you receive your loan.

#3: Phishing

Protect your passwords. Phishing (spelled with a P-H) attempts to steal usernames, passwords and other valuable financial info through electronic communications. Fake websites, bogus online payment processors or IT administration pages are setup and someone inputs their confidential information into them, which is then used to mine bank accounts or commit secondary acts of fraud, like identity left. So if a website looks fishy, it might very well be because someone is in fact phishing.

#2: Nigerian Scam

That African prince is actually an American con. Structured to attract the most gullible mark, this scam comes in the form of an email from a Nigerian official, who tells of a great fortune, which must be smuggled out of Nigeria with the recipient’s help. The recipient is asked to provide their banking information and promised a percentage of the fortune upon completion of the transaction. But in reality, the recipient gets nothing but an emptied bank account and a stolen identity.

Before we unveil our number one pick, here are a few honorable mentions:

- The Grandparents Scam

- Gold Buying Schemes

- Taxi Scam

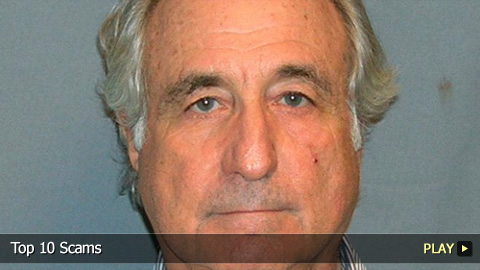

#1: The Ponzi Scheme

Named after Charles Ponzi, this mother-of-all-investment-scams promises high returns and little risk. While it seems like one giant pyramid scheme, it’s not: in pyramid schemes there’s a multi-level aspect where investors must recruit others. Ponzi victims only have to invest – which makes it seem less shady. Y’see, in the Ponzi scheme, no real investments are made. Old investors receive returns from the contributions of new investors instead of earning interest on their own money. For Bernie Madoff, this translated into billions of dollars, and ultimately 150-years in prison. For his victims, it spelled financial ruin.

Do you agree with our list? What dodgy deals and cheap tricks do you look out for? For more fun and informative top tens, published daily, be sure to subscribe to WatchMojo.com.