Top 10 Times Companies BETRAYED Their Customers

#10: Lenovo (2014-17)

You expect a little bloatware when you buy a new computer, not a backdoor for hackers. Between 2014 and 2015, that's exactly what happened with Lenovo. They shipped laptops with Superfish pre-installed. It was adware that didnt just flood your screen with ads: it hijacked secure web traffic, making encrypted sites vulnerable to attacks. The software used a fake security certificate, allowing anyone with the know-how to spy on your browsing, steal passwords, or impersonate websites. When experts raised the alarm, Lenovo initially shrugged it off. Combined pressure from Microsoft, federal agencies, and furious customers forced them to disable Superfish. By 2017, Lenovo was forced to pay millions in settlements.

#9: Hoover (1992)

In the UK, 1992 brought the deal of a lifetime, courtesy of Hoover. Hoover U.K. launched a promo offering round-trip flights to America with any purchase over £100. Buy a vacuum, fly for free. What they didnt expect was that customers would actually take them up on it... in droves. Unsurprisingly, the cost of the flights massively outweighed the profit from vacuum sales. Hoover tried to dodge their promise with fine print and delays. The public wasnt having it. The scandal exploded, leading to lawsuits, a government probe, and the collapse of Hoovers brand reputation in the UK. By the time the dust settled, top execs were fired, and the company was sold off.

#8: ABP Food Group (2013)

In 2013, ABP Food Group got caught red-hooved. The meat supplier was a key player in the infamous European horse meat scandal. Beef products sold in major supermarkets all over the continent werent 100% beef. Markets and restaurants like Burger King found horse meat and pork in their beef products. The public outrage was instant and international. While ABP blamed subcontractors, investigations traced tainted products back to plants in Ireland and the UK. It wasnt just false advertising; it was a full-on betrayal of trust that left customers gagging.

#7: Herbalife (2012-20)

From the outside, Herbalife looked like a booming health and wellness empire. Behind the scenes, it was being accused of running a pyramid scheme dressed up in protein shakes. Between 2012 and 2020, whistleblowers, investigators, and billionaires helped shine a spotlight on Herbalife's business practices. They relied more on recruiting new distributors than selling actual products. And despite said products being for weight-loss, numerous lab tests in the 2000s found them high in lead, even reportedly causing acute hepatitis in some consumers. In 2016, the FTC slapped Herbalife with a $200 million fine and forced it to restructure its business model. The damage wasnt just financial. Thousands of customers and recruits lost money while chasing false promises. Herbalife denied wrongdoing, but when your business model gets court-ordered therapy, its safe to say somethings off.

#6: Volkswagen (2015)

Volkswagen's clean diesel cars had a dirty little secret. In 2015, U.S. regulators discovered that VW had been intentionally lying about their emissions tests for years. The company installed defeat devices - software that could detect emissions tests and artificially lower pollution levels to pass. On the road, these same cars were spewing out up to 40 times the legal limit of nitrogen oxides. The reaction was massive and worldwide. VW had built its brand on trust, quality, and green innovation, only to be exposed as one of the biggest corporate liars of the decade. The fallout included over $30 billion in fines, criminal charges, and a CEO resignation. It was easily one of the costliest corporate scandals in decades.

#5: FTX (2022)

In the world of crypto, few names rose faster - or fell harder - than FTX. Touted as one of the most trusted exchanges, FTX turned out to be a house of cards. Founder Sam Bankman-Fried was secretly funneling billions in customer funds to its sister firm, Alameda Research. When the books were finally opened in 2022, the empire crumbled overnight. Customers lost an estimated $8 billion. Bankman-Fried was arrested and ultimately convicted of fraud. The company filed for bankruptcy, and the crypto market reeled. FTXs message of transparency and financial freedom was apparently for me, not for thee.

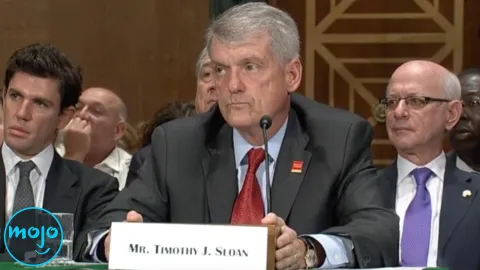

#4: Wells Fargo (2002-16)

For over a decade, Wells Fargo employees opened millions of unauthorized bank and credit accounts. Their customers had no clue that their names were being used by their bank. Fueled by impossible sales quotas and a toxic pressure-cooker culture, workers at Wells Fargo committed fraud on a massive scale. They forged signatures, created fake emails, and moved customer funds just to hit their numbers. The scope was staggering: more than 3.5 million fake accounts and at least 5,000 employees fired. The scandal was a public relations disaster; Wells Fargo had to shell out $3 billion in fines and settlements. Multiple executives were forced to resign in disgrace.

#3: Equifax (2017)

In the U.S., your credit score is enormously important and can decide your housing, job prospects, even phone plans. In 2017, one of the gatekeepers of those scores lost the plot completely. Credit giant Equifax suffered a cyberattack that exposed the personal data of some 147 million Americans. Social Security numbers, birthdates, and addresses were breached by hackers. Equifax knew about the vulnerability for months and did nothing about it. After delaying disclosure and bungling the response, they paid a $700 million settlement. It was a relatively small price for a betrayal that affected nearly half the nation.

#2: Facebook (2016)

In 2016, Facebook let your personal data walk right out the front door directly into a political psy-op. Through a shady quiz app, consulting firm Cambridge Analytica harvested info from up to 87 million Facebook users without their knowledge. That data was allegedly used to build psychological voter profiles to try to impact elections across the globe, including the 2016 U.S. presidential race and the U.K. Brexit votes. Facebooks response was abysmal, full of denials, delays, and dodging accountability. CEO Mark Zuckerberg eventually faced Congress, but the damage was already done. The world came to learn what experts already knew: Facebook users are the product, not the consumer.

#1: Boeing (2020)

When a brand becomes a punchline for tragedy, something has gone terribly wrong. In 2018 and 2019, two Boeing 737 MAX jets crashed within five months of each other. Nearly 350 people were killed. The cause? A flawed automated system called MCAS. It seems that MCAS was only installed to fast-track the 737 and outpace the competition. It was a move borne completely out of capitalistic greed. By 2020, the entire fleet was grounded, and Boeings reputation was in freefall. Investigations revealed a pattern of cut corners, regulatory manipulation, and shocking internal emails. The company paid $2.5 billion in penalties, but for many, Boeings biggest failure wasnt technical, but moral.

Did we miss a scandal that still makes your blood boil? Let us know in the comments below!